nh bonus tax calculator

An annual bonus from your employer is always a. Start filing your tax return now.

State Income Tax Rates Highest Lowest 2021 Changes

The Bonus Payroll Calculator Percentage Method Tags.

. New Hampshire has a 0 statewide sales tax rate and does not allow local. For taxable periods ending before December 31 2016 an 85 tax is assessed on income from conducting business activity within the State of New Hampshire. State of New Hampshire.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Social Security is taxed at 62 and Medicare at 145. The current combined Social Security and Medicare tax rate is 765 percent.

New Hampshire Aggregate Bonus payroll pay NH aggregate bonus payroll calculator pay check payroll tax calculator tax calculators tax calculator take home pay calculator retirement wage calculator payroll services calculator. Military bonuses are subject to taxation at the time of payment. Wage.

FICA taxes are Social Security and Medicare taxes and they are withheld from each of your paychecks in order for you to pay into these systems. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for. NHgov privacy policy accessibility policy.

Home For Sale Near Howard Elementary Tech School House Hunting Home Real Estate Home For Sale Near Howard Elementary Tech School House Hunting Home Real Estate Get 5 Back On Restaurant And Entertainment Purchases In 2021 Federal Credit Union Credit Union Cashback. 100s of Top Rated Local Professionals Waiting to Help You Today. Before the official 2022 New Hampshire income tax rates are released provisional 2022 tax rates are based on New Hampshires 2021 income tax brackets.

It is not a substitute for the advice of an accountant or other tax professional. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent. Below are your New Hampshire salary paycheck results.

Receive Blog updates via email. You will report the bonus as wages on line 1 of Tax Form 1040. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

The current Social Security tax rate is 62 percent for employees. The results are broken up into three sections. If your state doesnt have a special supplemental rate see our aggregate bonus calculator.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Hampshire residents only. The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. For multi-state businesses income is apportioned using a weighted sales factor of two and the payroll and property factors.

You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code. Nh bonus tax calculator Monday February 28 2022 Edit. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent.

Transfer Tax - here in NH we boast one of the highest transfer tax rates in the country at 15. Use the New Hampshire bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. And remember to pay your state unemployment.

The 2022 state personal income tax brackets are. TAX DAY NOW MAY 17th - There are -351 days left until taxes are. New employers should use 27.

One thing youll notice on your New Hampshire paycheck is deductions for FICA Federal Insurance Contributions Act taxes. Signing bonus taxes would fall in the above category if received via cash gift. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Recently accepted a new job. Our free online New Hampshire sales tax calculator calculates exact sales tax by state county city or ZIP code. Past rules mentioned earlier in this article issued by the Internal Revenue Service required the Defense Accounting And Finance Service DFAS to withhold 25 of that bonus later reduced to 22 on payment.

This free easy to use payroll calculator will calculate your take home pay. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. What is the Business Profits Tax BPT.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. The current Social Security tax rate is 62 percent for employees. Because this is no small cost buyers sellers realtors and loan officers need to know how much transfer tax will cost them when getting ready to buy or sell.

New Hampshires excise tax on cigarettes totals 178 per pack of 20. They should not be relied upon to calculate exact taxes payroll or other financial data. A cash bonus is treated similarly to wages and is taxed as such.

In the case of a non-combat zone military bonus pay or others subject. Plan smarter with the help of these payroll tax calculators. Ad Post Details Of Your Tax Preparation Requirements In Moments Completely Free.

They may not. New Hampshire Bonus Tax Percent Calculator Results. Or use the expertise of a tax pro to help you do so Signing Bonus Tax.

Supports hourly salary income and multiple pay frequencies. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. Bonus payroll pay salary paycheck calculator pay check payroll tax calculator tax calculators salary calculator take home pay calculator wage calculator.

2022 Federal Payroll Tax Rates Abacus Payroll

2022 Federal State Payroll Tax Rates For Employers

![]()

Portugal Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Understanding Your Paycheck Credit Com

How Is Tax Liability Calculated Common Tax Questions Answered

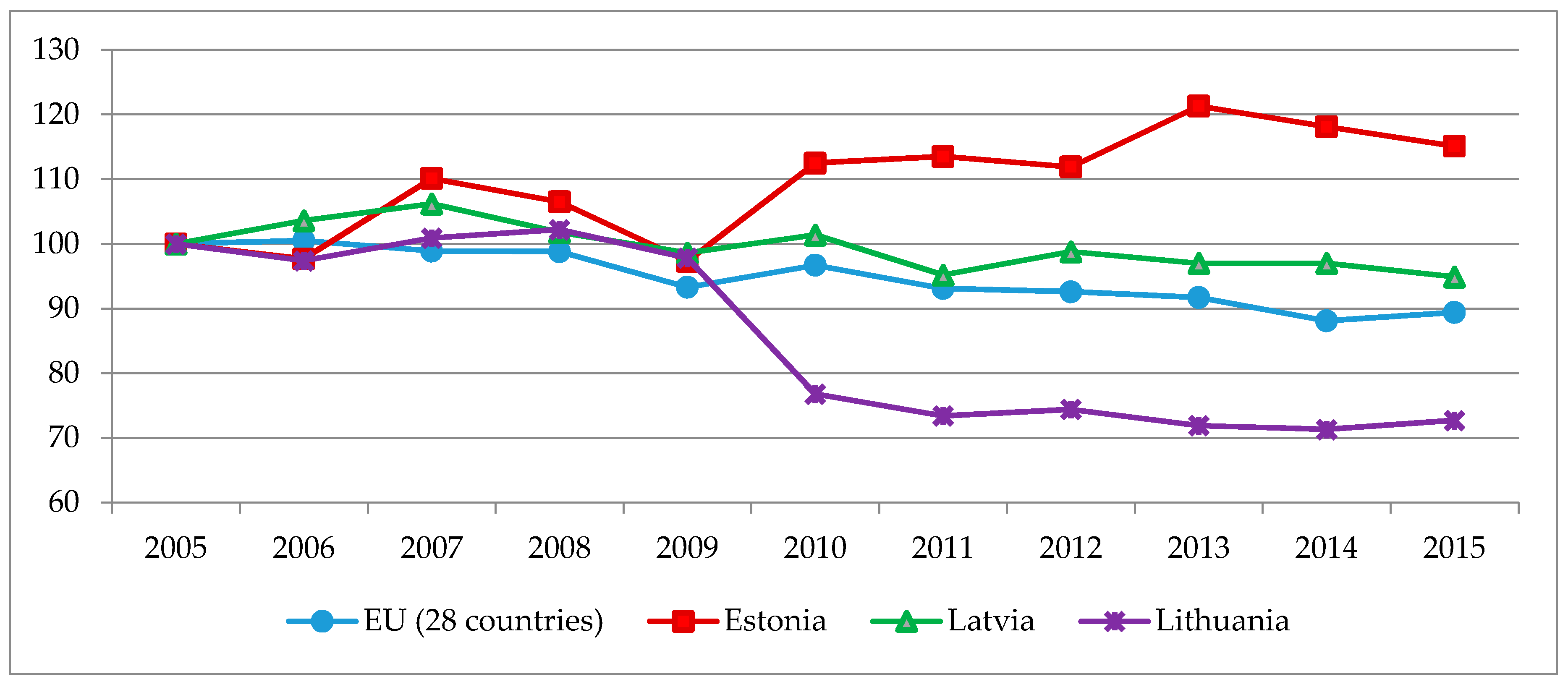

Energies Free Full Text The Impact Of Greening Tax Systems On Sustainable Energy Development In The Baltic States Html

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Premiere Suite Bali Nusa Dua Hotel

Flat Bonus Pay Calculator Flat Tax Rates Onpay

How Is Tax Liability Calculated Common Tax Questions Answered

Supplemental Tax Rates By State When To Use Them Examples

Deluxe Tax Preparation Software H R Block

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Tax Calculator Definitive Small Business Tax Estimator

How Is Tax Liability Calculated Common Tax Questions Answered

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep