unemployment tax break refund how much will i get

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. This is because the American Rescue Plan added that the first 10200 of unemployment benefits received in 2020 isnt taxable income.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

If youre married and filing jointly you can exclude up to 20400.

. Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Now roughly 13 million taxpayers who paid income tax on that money.

This is the fourth round of refunds related to the unemployment compensation exclusion provision. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a. So far the refunds are averaging more than 1600.

However a new tax break in effect only for the 2020 tax year lets you exclude the first 10200 from taxable income. For people who collected unemployment insurance during the pandemic in 2020 the IRS has been sending federal refunds if they paid taxes on that money. 24 and runs through April 18.

22 2022 Published 742 am. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

Recipients may not get a tax break this year which means they should take. The IRS has sent 87 million unemployment compensation refunds so far. The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes.

The expanded child tax credit for 2021 gets a lot of attention but thereâs another big tax change for families this tax season. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. The American Rescue Act also increased the rate of.

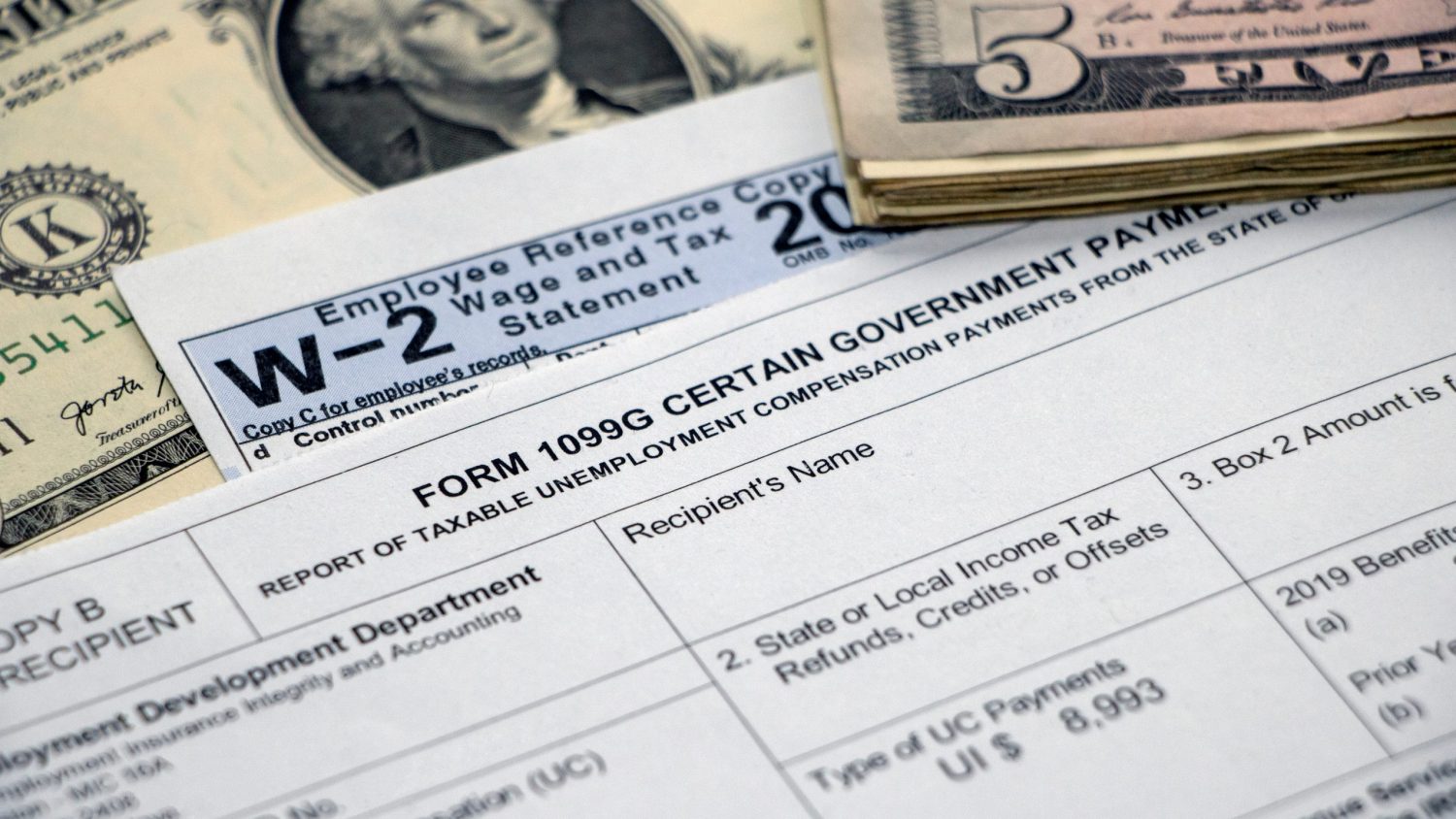

This batch totaled 510 million with the average refund being 1189. Generally unemployment compensation received under the unemployment compensation laws of the United States or a state is considered taxable income and must be reported on your federal tax return. The child and dependent care tax credit has been increased dramaticallyTaxpayers can now claim up to 8000 in expenses for one child â or up to 16000 for two or more dependents.

You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. When can I expect my unemployment refund. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000.

This is the fourth round of refunds related to the unemployment compensation exclusion provision. Heres what you. The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits.

This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. By Anuradha Garg. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000.

The tax break is only for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during the pandemic in 2020. Tax season started Jan. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online.

Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. This is the latest round of refunds related to the added tax exemption for the first 10200 of.

This handy online tax refund calculator provides a. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. If I paid taxes on unemployment benefits will I get a refund.

The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular rate. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. However not everyone will receive a refund.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. This applies both.

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify. If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income. The tax break is for those who earned less than 150000 inadjusted gross incomeand for unemployment insurance received during 2020At this stage.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Unemployment Tax Refund Could Put Thousands Back In Your Pocket

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Tax Information Center Other Income H R Block

Taxable Benefits Explained By A Canadian Tax Lawyer

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Interesting Update On The Unemployment Refund R Irs

Still Waiting For Your 10 200 Unemployment Tax Refund How To Check Status Dailynationtoday

When To Expect Unemployment Tax Break Refund

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time